If you’re planning to sell coin collection, knowing market timing and buyer types can save you thousands. It consists of one question alone: is it time to sell? Perhaps it is a box of old Canadian coins you inherited or years of collecting and now you are ready to cash them in. Whatever the case may be, the coin market is complicated, emotional and rife with opportunities, provided one knows where to seek them, when to strike and what really counts today, in the changing collector environment.

You must be aware of what makes it valuable, some of the pitfalls to avoid and how you can safeguard your investment before selling it. Is yours a strike to win a profit, to streamline or just to make a legacy? Here all you have to know to sell your coin collection smartly in a clever, fearless and unregretful way i.e. intelligent, tactical and assertive.

Know the True Value Before You Sell Coin Collection

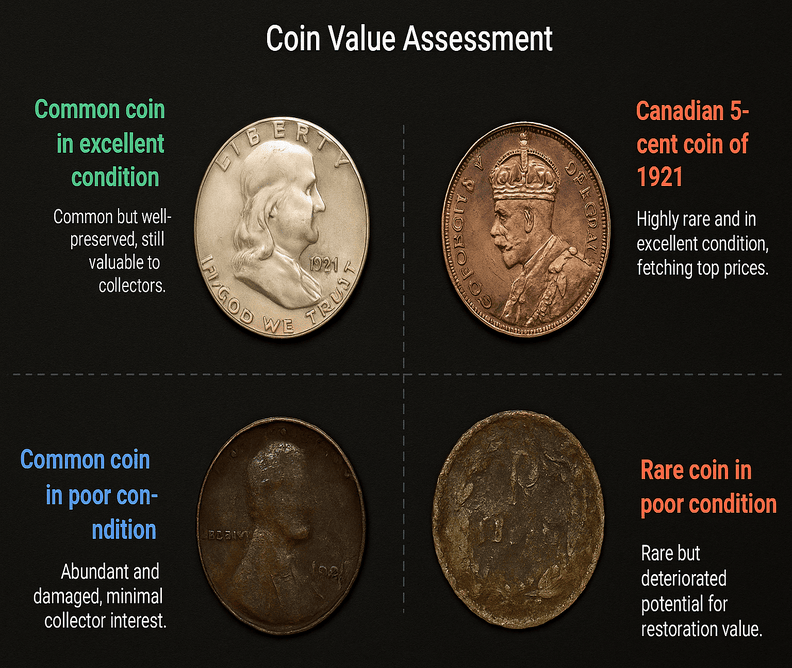

All coins are not of equal value. A Canadian 5-cent coin of 1921 had been auctioned more than once with the price exceeding $250,000, whereas the coins of the same period can be bought for several dollars. Value is based on rarity, condition, mintage and demand of the market. It is possible even to create a coin that even with identical appearance; one may be worth orders of magnitudes more than the other due to the differences in quality of the strike or background history. The most important ingredient in making the best selling decisions is knowing what you have and why it matters.

Get your coins evaluated by a reputable coin dealer or numismatic expert. On-line estimates can be deceiving. Graded coins (especially those graded by PCGS or NGC) will have higher value and tiny creatures such as die marks or mint marks will make a huge difference in value. A professional is likely to notice details that can increase the price by thousands, so you do not end up paying less than the rare or historic ones are worth.

Read More Blog:- Natural Diamonds vs Lab-Grown Diamonds: What Buyers in Brampton Should Know

Market Timing Makes a Big Difference

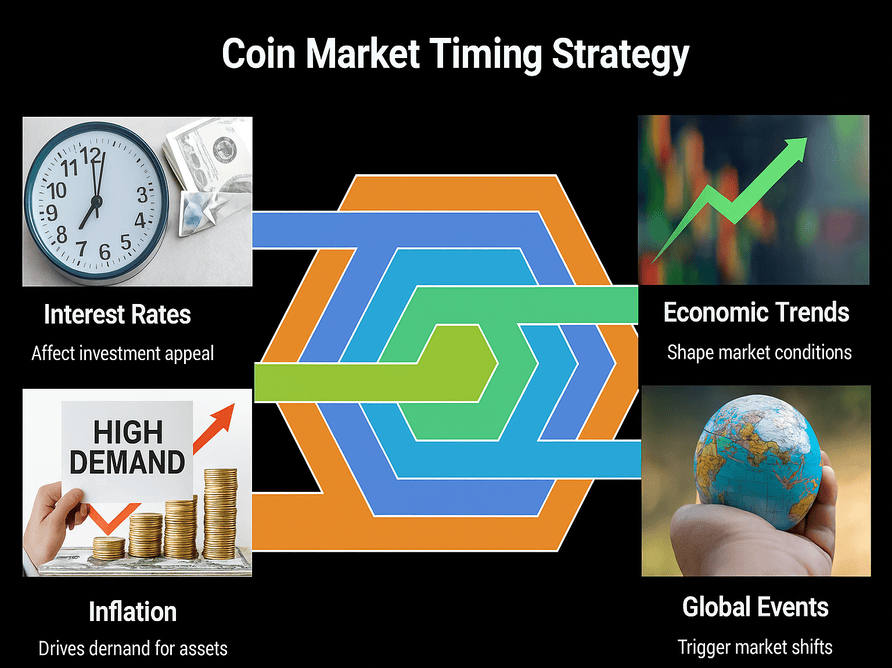

Timing is everything just as it is with real estate or gold. The prices of coins vary in line with the economic trends, the rate of interest in the coins, and even the events occurring in the global world. As an example, when the financial crisis hit in 2008, bullion based coins saw a spike in their demand since a lot of people wanted to get into a stable investment. This can have a big impact on the amount you will end up getting upon getting sold at a high point of interest and not at the time of market stagnation.

Nowadays, due to inflation issues and the interest in physical assets, the demand for gold and silver coins, especially Canadian Maple Leaf coins, is high. Selling in a bull market may add 10 to 30% or more of extra proceeds to the cash price, and that alone should justify your using it as a prime-time opportunity to sell your coins.

Read More Blog:- The Smart Way to Trade Old Banknotes and Rare Paper Currency

Understand the Types of Buyers

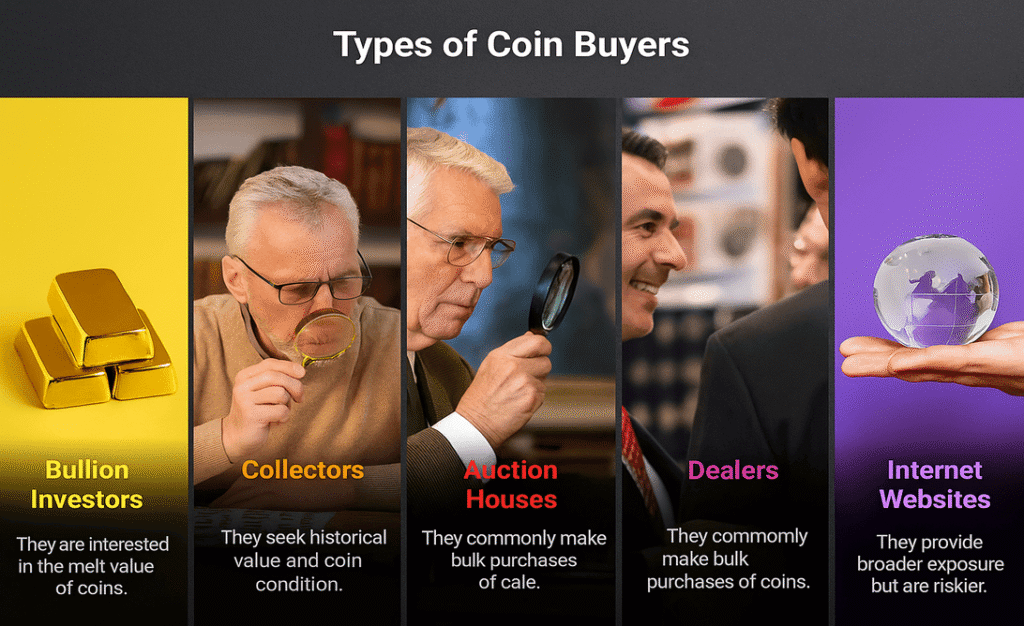

Various kinds of collections have different buyers. Bullion investors want to know the melt value and collectors want historical value and condition. The higher value items are sold through auction houses, bulk purchases are common by the dealers. Broader exposure can be obtained via the internet through such websites as eBay or numismatic specific websites but these services may cost more money and be more risky. Selecting one Cataloguing medium or another on the basis of the profile of your collection can make a great deal of difference to the speed and profitability of the sale.

To give an example, a 1969 Canadian dime with a large date would be of interest to casual collectors, whereas a well-preserved 1936 Dot penny, one of the rarest Canadian coins, would probably end up in the collections of a specialist or a museum. Before you make a list, know whom you are dealing with because even with inflation, there is always the appeal to matching the coin with the right buyer, as there is the likelihood of selling a coin on the spot and getting the most out of the real value of the coin being bought.

Read More Blog:- Sterling Silver in Canadian Coinage: The Story of the 1887 Quarter

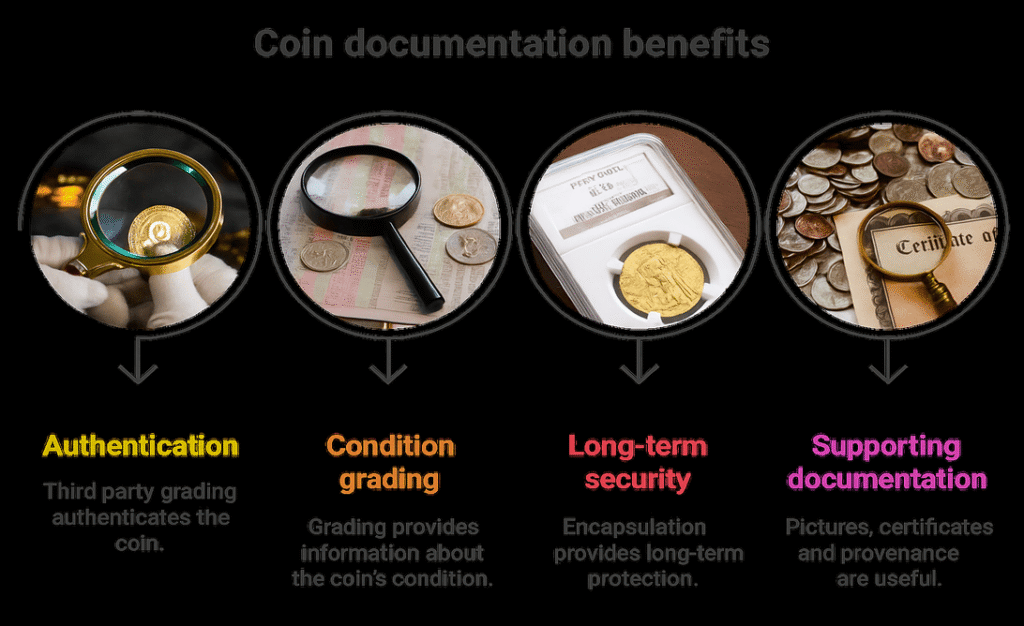

Documentation and Grading Add Serious Value

Being able to get your coins certified and properly documented can add to the amount of trust- and price. A raw coin is worth $50 but the same coin with the same grades by the NGC could be worth 500 dollars. Third party grading helps the buyer know exactly what they are buying, providing authentication, condition grading and long-term security and all these can greatly improve the buyer confidence and the ultimate selling price.

Pictures, certificates, provenance (where and how you got the coin) etc. are useful as well. Collectors prefer to have the clarity of their joint coin, especially the rare or valuable pieces. But in case you have had them in a display, safe, or capsule-say so. Condition and care is important, and the more you can give the background of what you are selling, the better you are going to feel about the asking-price, and the quicker you are going to offload the item.

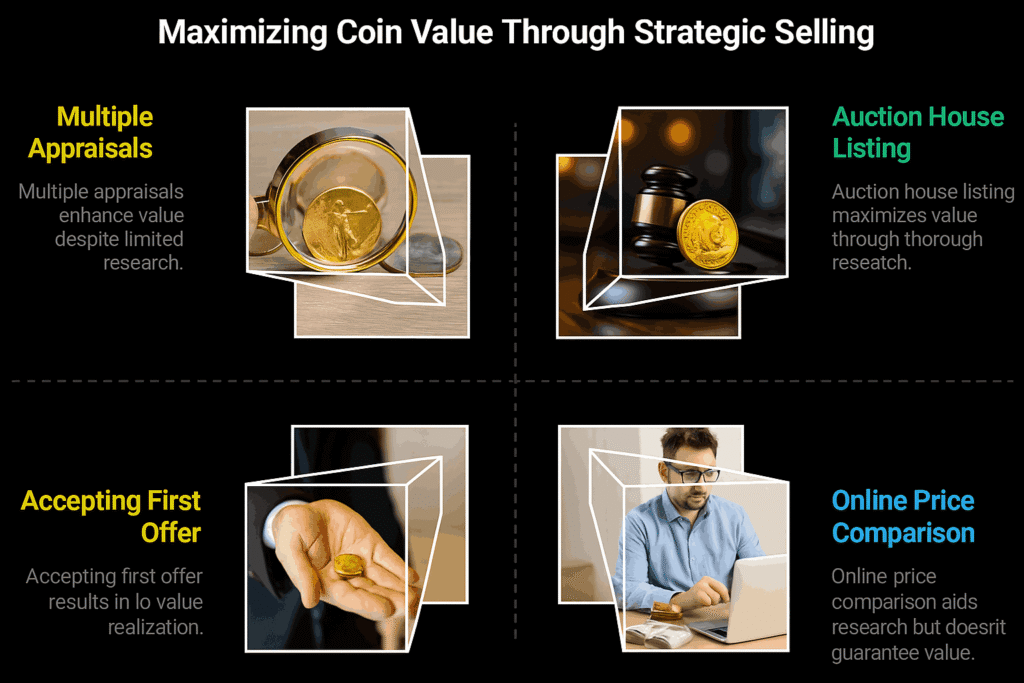

Avoid Selling to the First Offer

You may be tempted to accept the first offer that makes sense, at least when you are not sure what the value is. However, a lot of sellers miss out on the money in this fashion. At shows, particularly coin dealers in the local pawn shops, one may get 40-60% on the dollar. They consider their own resale profit, expense and risk of the market. By shopping, having several appraisals done, or even listing your coin in a well-known auction house will show its actual value- and in many instances will bring you much more.

Multiple quoting must always be done. This is due to the online auction houses such as eBay or Heritage that display actual coin prices being achieved and not merely what the sellers are quoting it. Even the little research can mean hundreds of (or even thousands of) dollars. A pictorial idea of the actual market price on your coin can be clearly provided by making comparisons on the recent sales done, checking through lists of items which have gone through and a feel of the buyer trend as well.

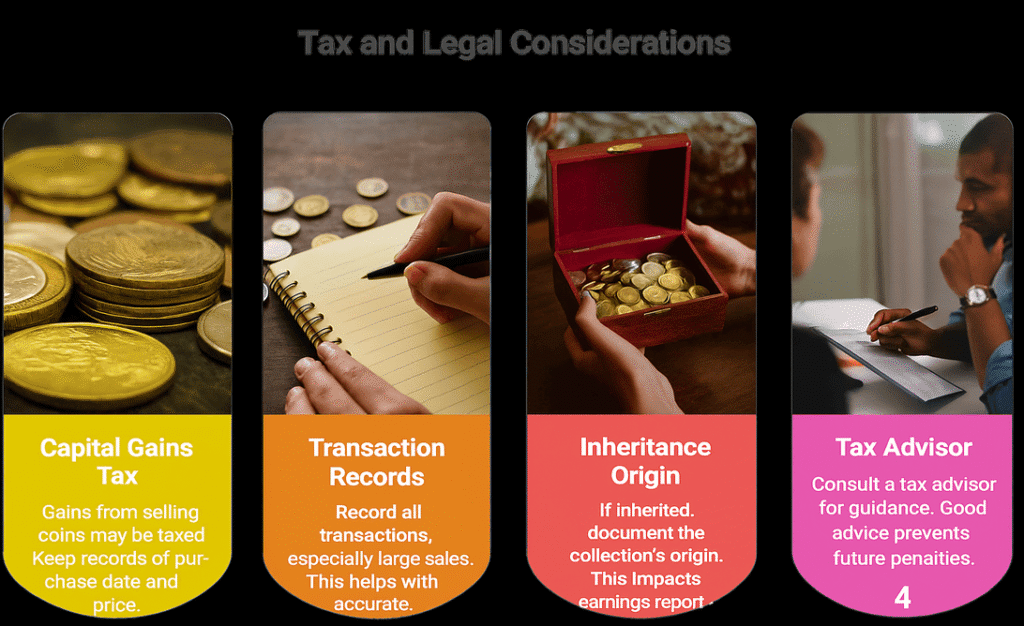

Consider Taxes and Legal Implications

Yes, selling coins can be income. It bears mentioning also that capital gains tax could be owing to the Canadian Revenue Agency if your coins appreciated much since acquisition. In other words, gains made on a sold coin that was purchased by an individual at a price of 200 may be partly taxed assuming it is sold at 2,000. You should maintain a thorough documentation of date and price of purchasing as well as a tax professional so that you are not underreporting and availing as many exemptions as you can.

As well, record your transactions, especially those of big sales. In a case where you inherited the collection, its origin may be recorded in such a way that it influences the reporting of earnings. Never get surprised and incur more surprises because you did not inquire to a tax advisor, good records and advice can save you future tax penalties and you can learn to do your future selling or reinvestments better.

Online vs. Offline: Where Should You Sell?

Selling online advantages is the increased audience base; selling online disadvantages are scams, payment delays and high shipping insurance. Mid level pieces are sold via such websites as eBay, Etsy or even Facebook marketplace. Be cautious and check seller protection, such as safe payment, seller ratings, and returns and make the transaction safe and easy.

Local coin shops, auctions, estate sales, the coin shops are more one on one. They will also be able to provide expert hassle and minimize shipping, particularly in the case of larger or larger fragile collections. There are even those collectors who have gone to the extent of selling some of their collection in both the arena so as to gain maximum exposure- the trust and paces of the direct sales experience mixed with the greater exposure of the internet world.

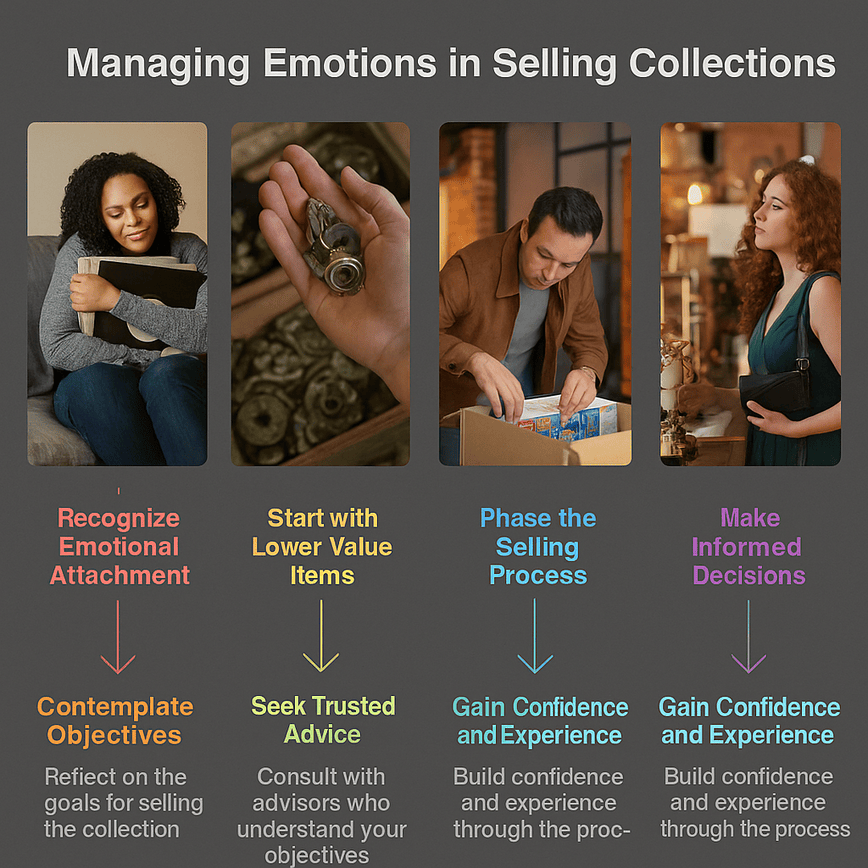

Emotions Can Cloud Judgement So Plan Ahead

Selling a collection may be a very emotional process, particularly when it has some family or life span attachment to it. There are many collectors who wish they had not sold too early or not known long-term value. Besides the financial value, coins may have stories, milestones or meaning that a person cannot acquire a substitute of. Spend time contemplating what you want to achieve by making this kind of decision, whether that’s legacy preservation, donation of something meaningful, or the simple act of decluttering, and ensure you feel good about the move and not under time pressure.

If you are unsure, begin with selling copies or better items which have lower value. This will give you confidence and experience. You may simply work with a dealer or trusted advisor that believes in your objectives whether it is to maximize profit, streamline assets, or legacy of a loved one. By going through the process in phases you will have time to learn how to do it and find the right relationships, get a feel of what items you feel comfortable selling, and make decisions without the added stress of having to sell your most precious items immediately.

Conclusion

Selling a coin series is never only a business of selling some metal, it is a business of selling history, memories, and investments that have both financial and emotional values. With a proper preparation, that is, correct valuation and proper timing you can achieve the respect and the worth your collection is entitled to be seen to acquire in the modern coin market that is changing.

Planning your market dynamics, finding the correct buyers and proper documentation will reduce the risks and optimize the returns. It can be rare Canadian coins, bullion pieces or family heirloom collections but any form of strategic and informed approach can secure your legacy and place you in the most favorable position.

At B&W Coins, we will take the collectors and investors through each phase of the selling process by providing expert values, candid advice, and market-based information. Being rare, single or a collection of pieces, our team does everything to make it a smooth, fair and professional process. Believe us to make you of your collection good value, with ease and certainty.