It is a sunny Saturday afternoon. You end up opening an old wooden box that you inherited after your grandfather. There are several dozen coins inside, some shiny and some old. You do not know what they are but one of the neighbors told you that it might be a 1958 Canadian silver dollar. You are wondering, and you go to Google for its price and get contradicting prices. It is priced at 30 dollars at one site and 80 dollars at another one. So the question is what is the true worth? But more to the point, how can you be sure that you are not being lowballed?

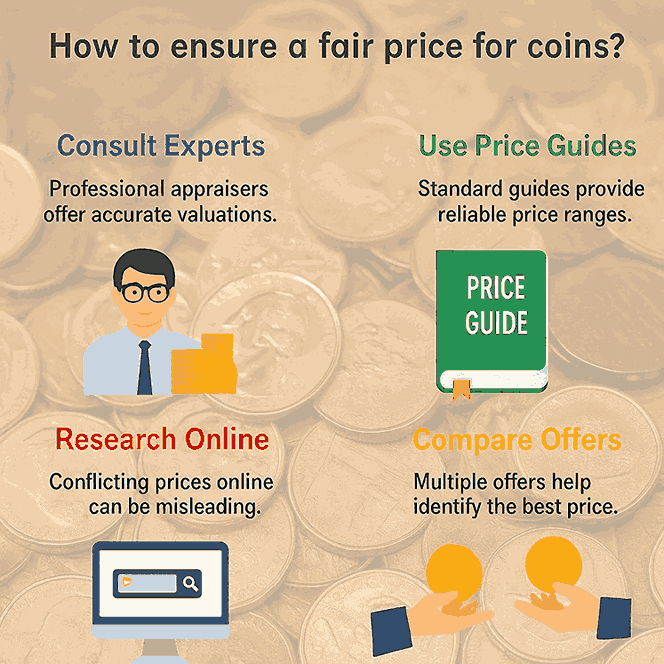

The situation is common to a great extent. As a collector you may have accumulated a lot of coins in your collection and as a first time opener you are also having your concerns as to how to get a fair price of your coins. However, by knowing the right knowledge, tools, and questions you can prevent common traps and obtain a price that is worth something.

Understanding Coin Value: More Than Just Metal

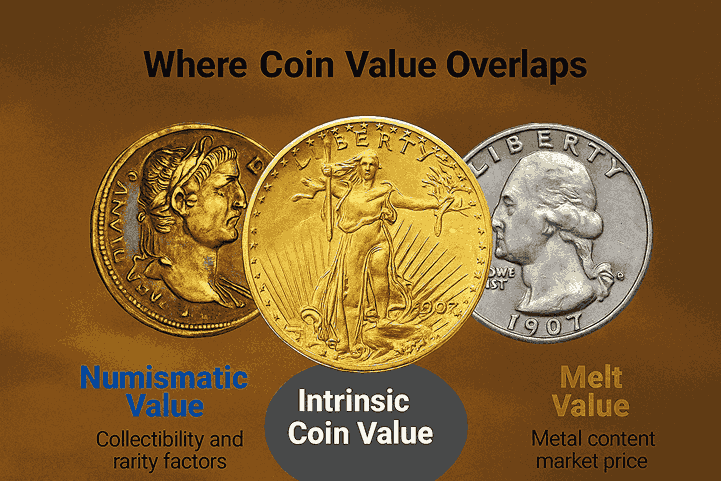

The value of all the coins is not equal. As a matter of fact, there are two broad categories of coin value namely, numismatic and melt. The value of numismatic is anchored in scarcity, status, production defects as well as cultural demand. A gold or silver item such as the 1967 Canadian silver dollar with Canada Goose on it is likely to fetch more on its own military rather than the value of its silver content because it is collectible.

Melt value on the other hand, is the price of the metal content on the market, e.g. what you would receive should the coin be melted down. A case example is the Canadian silver dollar which is 0.6 troy ounce of silver meaning that at the time when silver is being traded at 30 dollars per ounce, the melt value would be about 18 dollars.

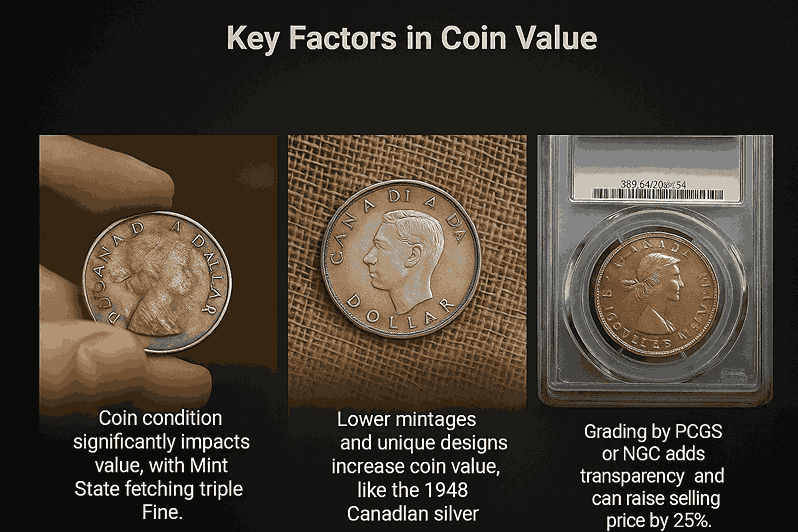

How Grading and Rarity Affect Value

Coin condition has a big bearing on value. The scale applied on grading runs between Poor (P-1) and Mint State (MS-70) with a difference between them affecting the price. The same coin of the Canadian dollar in MS-65 may be valued three times that of the coin in the Very Fine condition. Some years are more desirable in terms of being less minted (or have special designs). Case in point, the 1948 Canadian silver dollar because of minimal production is even more rare and worth over $1,500 at auction in case it is well taken care of.

Having your coin graded by PCGS or NGC gives the coin patch of authenticity and credibility on the buyer’s part. It gives an independent evaluation of the status of the coin which is vital in the collector area. Graded coins have a higher chance of selling and fetching a high price. In most situations, correct grading may increase your selling cost by 25 or even more percentages.

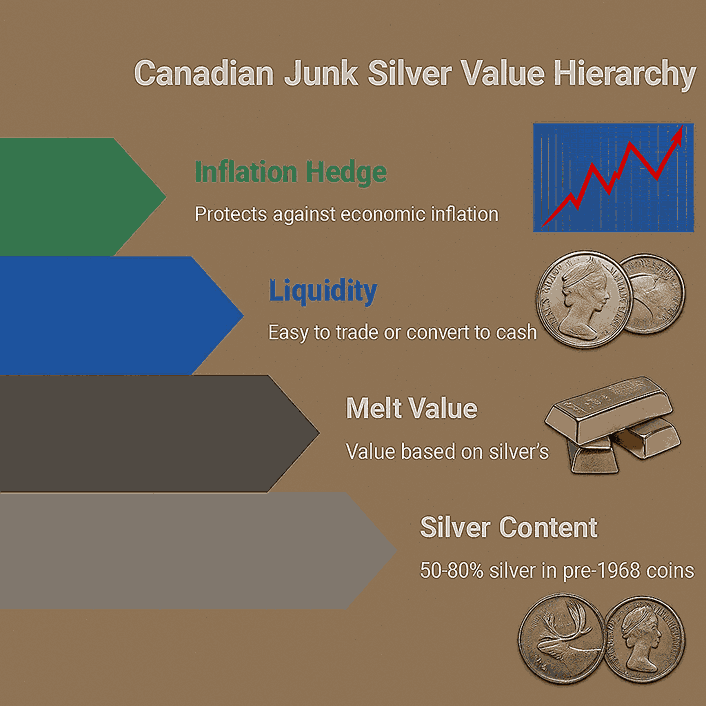

The Role of Canadian Junk Silver in Pricing

Canadian junk silver are the pre 68 minted coins that have the content of between 50 percent and 80 percent silver. Although these coins are not rare as well as hardly collectible, they are valuable due to the silver material they contain. They are frequently purchased by the investor as a cheap means to hold physical silver. They can also be liquidated easily or traded because of their recognizable form as well as their historical importance.

As an illustration, the 1964 silver quarter roll has approximately 2.8 troy ounces of silver. That’s 84 dollars per oz at 30/oz. Junk silver is a favorite of investors both in its liquidity and in inflation-proofing. Nevertheless, not every buyer will give full melt value particularly in case the coins are worn or damaged. It is therefore important to know the melt and collector value of an item before resolving to take an offer.

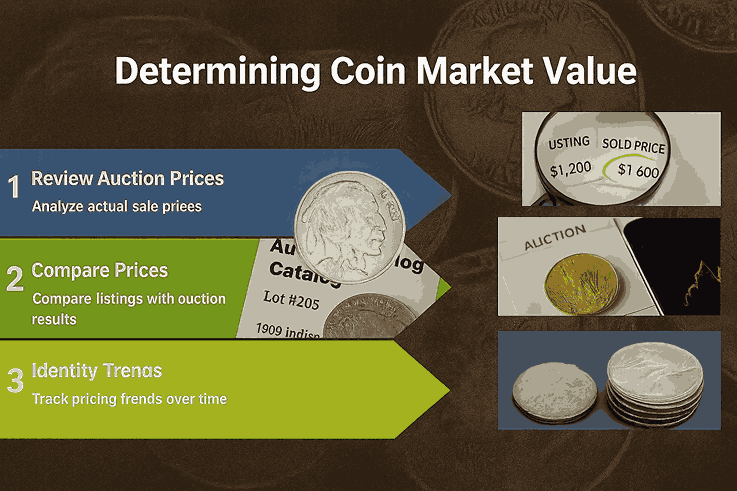

Coin Auctions: The Market’s True Voice

Sale prices/actual prices are useful references to help you get the real picture of your coin on the market. Good sources include Colonial Acres, Heritage Auctions and eBay. Such websites give the details of what collectors are paying and not necessarily what sellers are asking. To use the example of a 1958 Totem Pole dollar, retailing at $70 on whatever web site you care to look on, but in fact selling consistently, at auction, at a value of $45, you have a better gauge of what it is actually worth at this moment. One can monitor the changes in pricing and market demand by tracking these platforms.

Online vs. Local Dealers: Where Should You Sell?

Such online exchanges such as BW Coins provide the secure and transparent systems of coin valuations, where there is also the benefit of being available to the nation as a whole. They are usually able to offer more competitive prices as compared to local shops which consider the cost of overhead and inventory. A lean process also enables the sellers to compare the offers and to conclude the transactions effectively.

However, with a local dealer, one would have the advantage of paying immediately since it is a local dealer and also it would offer more direct experience face to face with the dealer. It is always wise to get the offers of the online and local dealers so that they can be compared. And the most important thing, always inquire how they came up with the price- a dealer who cannot give a reasonable answer on how he reached his value should then give the red signal.

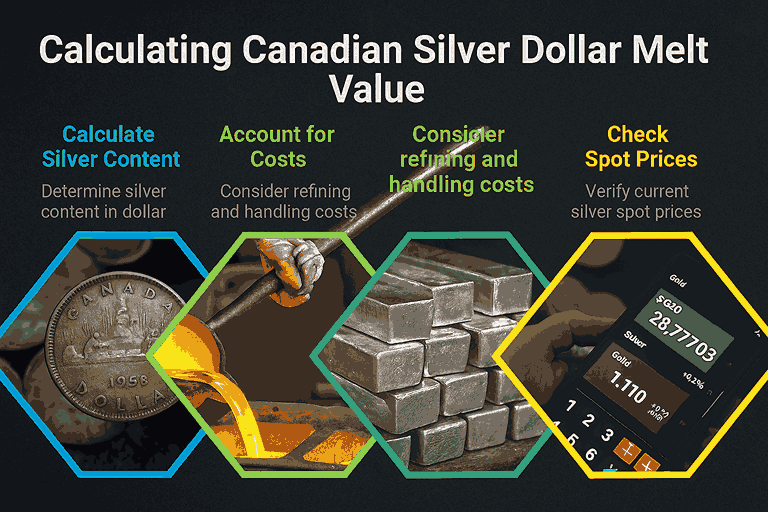

Understanding the Canadian Silver Dollar Melt Value

Silver on offer as of mid-2025 is something like $29.70 (USD) per ounce. Considering the fact that every Canadian silver dollar holds approximately 0.6 troy ounces of silver, its melt value is approximately 17.82$ USD. This value is subject to going up or down depending on the silver market of the world. It is not an indicator of collectible value; however, it is a guideline to bullion-oriented collectors.

Remember that the cost of refining and handling an item might make buyers buy it a bit below its melt value when they are buying in bulk. Before going there, it is also wise to look at live silver spot price, this gives you an edge in reaching an agreement. There are websites such as Kitco and SilverPrice.org which offer up-to-date information to make you ready and aware.

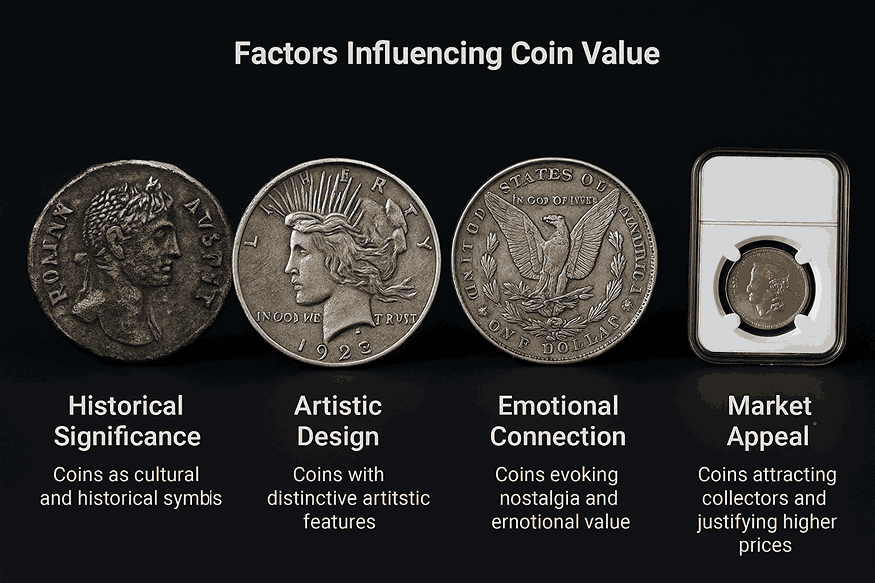

How Coin Design and History Impact Value

Coins are objects of stories- and people who are interested in collecting coins are willing to pay a lot of money because of this story. Totem Pole dollar, produced in 1958 to commemorate the 100th anniversary of British Columbia, is one of such cultural and historic symbols. It is the same with the 1967 Centennial coin series which brings a lot of nostalgia in baby boomers, giving more emotional importance to the coin than just being metal.

These sentimental attachments can shoot the market price of a coin. Coins which form historic series, or possess particular artistic designs tend to have a greater attraction to collectors at an emotional level. During the selling, you should not forget about these points, these might turn out to be your best selling item and make the asking price higher.

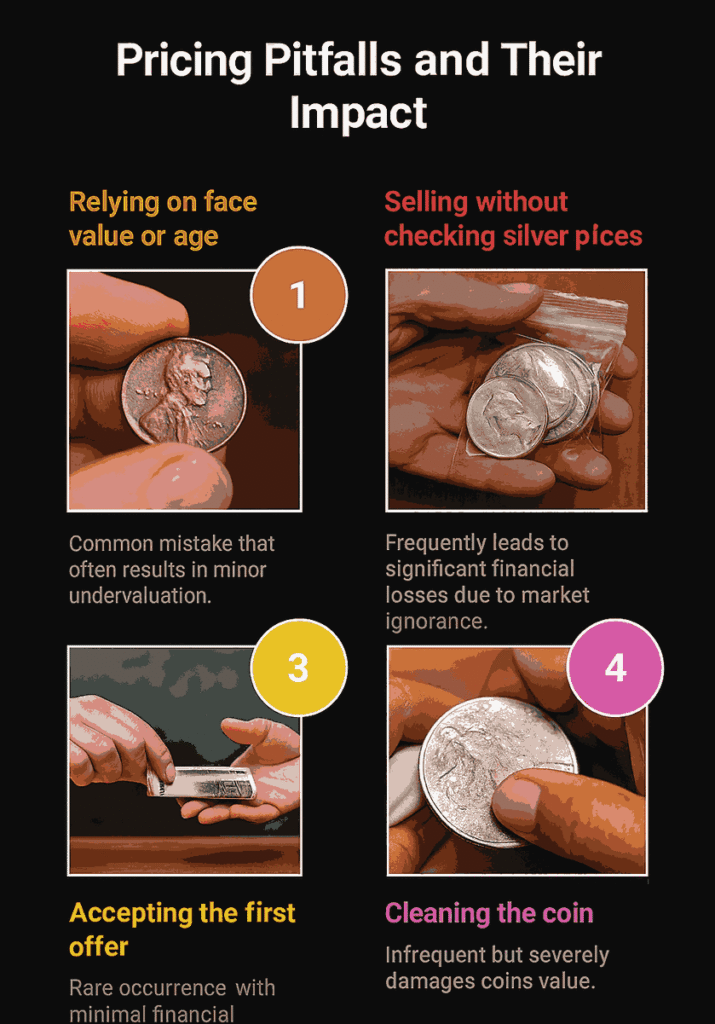

Common Pricing Pitfalls to Avoid

It is here that most sellers make their mistakes; selling without looking at the current silver prices, or just going by the face value or the age of the coin and not looking at the grading and condition of the coin before accepting the first offer. Such pitfalls may result in underestimating your coin and failure to understand its real value.

Even worse? Cleaning of your coin. Although this may appear to be a valid idea to have it shining, it can drop the numismatic value by 30 percent and even more depending on the kind of cleaning done to it. Natural wear and patina is well preferred by the collectors as this maintains the authenticity and historical value in the coin.

Tips for Buyers: Get What You Pay For

When intending to sell or purchase Canadian silver dollars, first you should look out fakes that are not in fact genuine silver as they are not magnetic and should weigh and measure accurately. Make sure to grade the coin using authorized substances such as PCGS or NGC to have accuracy. Ask for a clear image with closer shots in daylight so that the exact condition of a coin can be evaluated before an exchange.

To ensure extra security, purchase only on trusted resources that provide authentication, price fairness, and decent descriptions. Verified sellers will get you out of the predicaments of dealing with phony markets where there is no security of the buyer. Better to pay a little more just to have a peace of mind rather than involve in a deal that seems to be too good to be true.

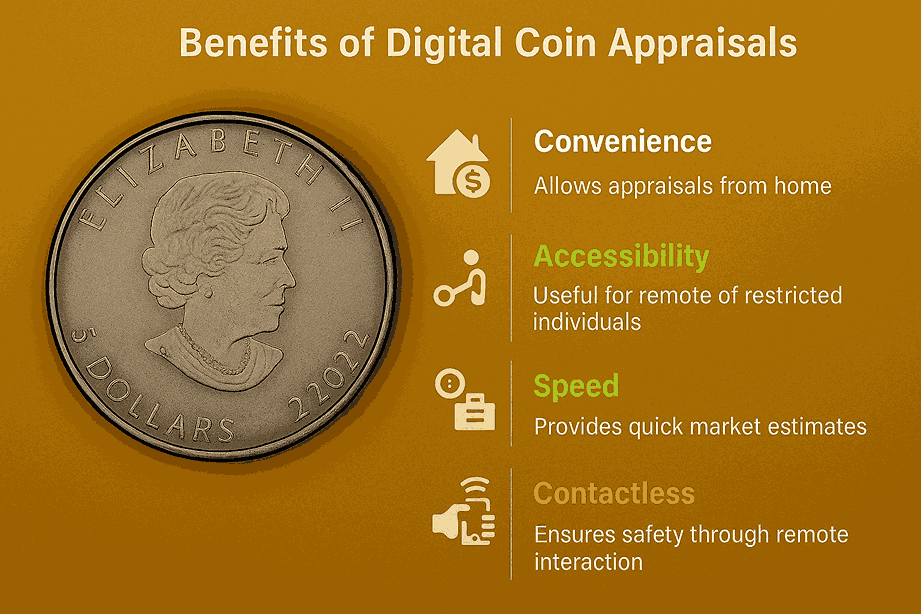

Digital Appraisals and Virtual Consults

Not able to go to a coin store? A large number of the best dealers have become capable of providing digital appraisals and online consultations so that you can have your coins with you professionally appraised with the convenience of your home. Upload images of both sides of your coin at high-resolution and have a close up you can measure the weight or known history which will help dealers ascertain the mint marks, condition, rarity, and type of metal.

Such service is very useful to those sellers who locate far and collectors who have mobility restrictions or have large/inherited collections. It is also a quick, time-saving, and contactless method of knowing the worth of your coin because most dealers give the fair market estimate within 24 to 48 hours without needing to leave the house.

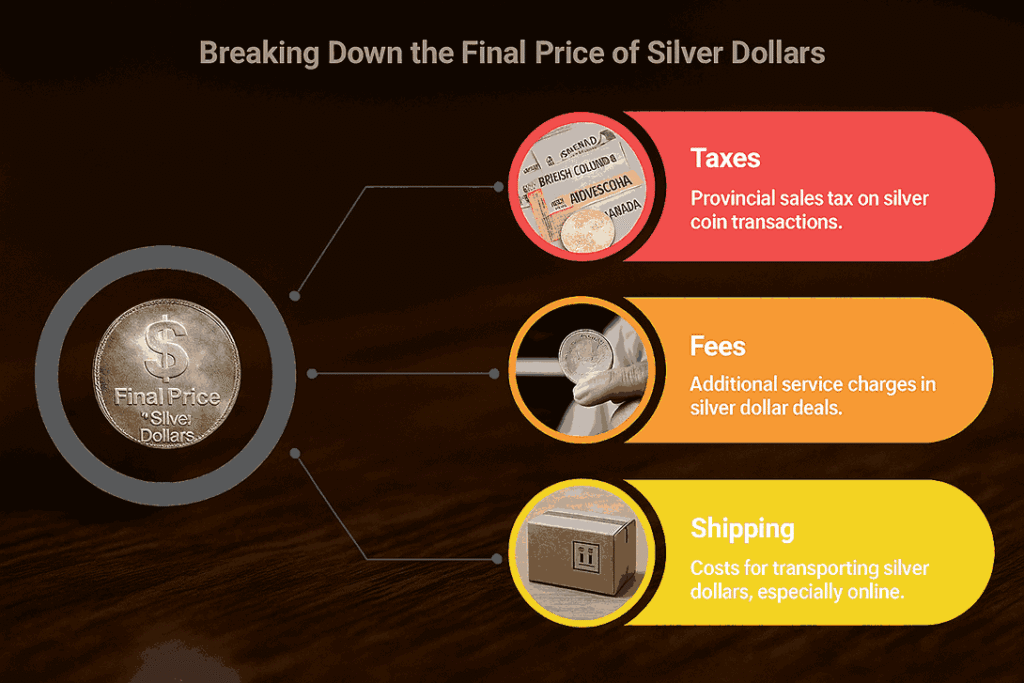

Taxes, Fees, and Shipping: The Final Price Tag

When trading in Canadian silver dollars, it is imperative to observe other than the price listed by the coin. The level of tax can be very different depending on what province you live in-some provinces include sales tax on sales of silver coins, and in others investment grade silver is not taxed. Local rules should be checked or asked at the dealer to come clean about it.

Moreover, do not forget about shipping and handling fees, in the case of online sites. Credible brothers and sellers can also offer to commit shipping labels or send them off at local sites to assist with a shift. In case you are quoted a net price, make sure it has not already taken taxes, shipping costs, or service costs in consideration. This transparency makes you receive the full value of your transaction without any concealments.

Conclusion

It simply is not just getting an adequate price on your coins by understanding how much silver is in them, rather it is the whole picture. Pricing is both art and science that stretch all the way to historical relevance, numismatic rarity, market trends and emotional value.

Your coin is interesting to you not only because of the melt value but also because of the story that your coin is part of: its year, its design, its condition. And as an investor, having access to information about the spot prices and being able to time the market is a concrete way of turning the profit margins.

Avoid the pitfall of taking clouded proposals or making old time assumptions. Order it with new data on auction, request multiple quotations and look at live melt prices at all times. On such classic issues as the 1958 Totem Pole dollar or the 1967 Centennial issue, a difference in grades can (or can not) translate directly to dollars that vary in your bid.We, at the BW Coins, are confident that everything fair is built on knowledge. It is because of this that we have transparent pricing, expert appraisal of properties, and real-time value insights, be it selling, purchasing, or scrutinizing the situation.